CONTRACT OF GUARANTEE

Meaning and Definition

A guarantee is a contract to pay the amount due to from another person if he fails to pay. The person who gives the guarantee is called the surety or guarantor.

The person to whom the guarantee is given is called a creditor.

The person in respect of whose default the guarantee is given is called the principle debtor.

Sec. 126 states, "A contract of guarantee is a contract to perform the promise or discharge the liability of a third person in case of his default."

Examples

a. A asks B to lend Rs. 5 Lac to C. A guarantee that if C fails to return the loan, A will pay to B. It is a contract of guarantee.

b. On the request of B, A promises with the employer of B that if B commits a fraud, A shall be liable, It is a contract of guarantee.

Essentials

The following are essentials of a contract of guarantee:

1. Tripartite Contract

In a contract of guarantee, there are three parties namely principal debtor, creditor and surety. Under the contract, three separate contract are made among the parties. All the essentials of a valid contract are required for a contract of guarantee. The principle contract exists between the principal debtor and creditor while the secondary contract exists between the creditor and surety.

Example

X takes a loan of Rs. 5000 from Y on the guarantee of Z. The agreement between X and Y is the principal contract and the contract between Y and Z is a contract of guarantee. The liability of Z will arise if X fails to repay the loan.

2. Consideration

A contract of guarantee must be supported by some consideration. A consideration received by the principle debtor is the consideration for the surety and it is not necessary that there must be benefit for the surety. [Sec. 127]

Examples

a. A sells goods on credit to B on C's guarantee. C's guarantee is the consideration for A's promise to sell the goods.

b. A sells goods to B. X requests A not to sue B for a week, and promises to pay if B does not pay. It is consideration for X's promise.

3. Misrepresentation

A guarantee obtained by means of misrepresentation made by the creditor regarding the facts of contract is invalid. If consent of surety is obtained by misrepresentation, the surety will be discharged from his liability. [Sec. 142]

Example

H was invited to give guarantee for L's servant. L had previously dismissed his servant for dishonest but did not disclose this fact to H. Later, the servant misappropriated the money. Held, H was not liable. ( LGO Co. vs. Holloway)

4. Concealment

The creditor must disclose all the material facts regarding the contract to the surety before entering into a contract. If the creditor conceals the material facts of contract from surety, and thus obtains his consent, the contract is invalid. [Sec. 143]

Example

A employs B to collect money. B misappropriates the money. Later, C gives guarantee for B on A's request. B again misappropriates. C's guarantee is invalid because A concealed the facts.

5. Primary liability

In a contract of guarantee, the liability of principle debtor is primary and the liability of surety is secondary. The liability of surety arises only when the principle debtor defaults. The liability must be enforceable by law. If liability does not exist, there is no contract of guarantee.

6. Writing not Necessary

It is not necessary that a contract of guarantee must be in writing. The contract may be oral or written. It may be express or implied. The implied guarantee may result from the conduct of parties. [Sec. 126]

Example

A sells and delivers goods to B on the verbal guarantee of C. It is a valid guarantee.

7. Capacity of parties

All the requirements for a valid contract i.e. free consent, consideration, lawful object, etc. are necessary to form the contract of guarantee. But the other parties must be competent to contract.

Example

F, a minor, takes a loan from G. W gives guarantee to G for the repayment of loan if F refuse to pay. It is a valid contract.

Types of Guarantee

The following are different types of guarantee:

1. Specific Guarantee

A guarantee which is given for a single debt or specific transaction is called ordinary, simple or specific guarantee. The liability of surety comes to an end when the debt is paid or specific transaction is performed.

Example

a. C gives a loan to B for which X gives a guarantee. It is a specific guarantee.

b. G guarantee K for payment of 5 bags of wheat purchased by C. C makes the payment. Later, C again purchases 5 bags of wheat but did not pay. K sued G. Held, G's guarantee is specific guarantee and G is not liable. ( Kyk vs. Groves)

2. Continuing Guarantee

A guarantee which is given for a series of debt or transactions is called Continuing guarantee. It does not come to an end on the performance of single transaction or discharge of a debts. It covers all the transaction. At the time of giving the guarantee, the surety can fix the amount, time etc. [Sec. 129]

Example

D guarantees C for B's purchases from C up to Rs. 5 Lac within one year. It is a continuing guarantee.

Rights of surety

A surety has the following rights:

a. Rights to Securities

When a surety pays the guaranteed amount, he can demand the security which creditor has received from principal debtor at the time of contract, whether surety is aware of such security or not. If creditor by negligence losses any security, the liability of the surety reduces proportionately. But if security is lost due to unavoidable act, the surety shall remain liable. [Sec. 141]

Example

C gives a loan of Rs. 2 Lac to B on the guarantee of X. C also pledges B's car. B fails to pay the loan and X pays Rs. 2 Lac to C. X can get the car from C.

b. Right to Counter Claim

Counter claim means a deduction from the amount of loan. If the principal debtor makes a counter claim against the creditor, the surety can ask the creditor for adjustment of claim.

Example

A supplies furniture worth Rs. 2 Lac to B on the guarantee of C. B claims that some furniture is defective and refuses to pay Rs. 20,000. C can ask for adjustment of Rs. 20,000

2. Against principal Debtor

A surety has the following rights against principal debtor:

a. Subrogation

Subrogation means substitution of one person for another. When the surety pays the guaranteed debt on the default of principal debtor, the surety is entitled to all the rights which creditor has against the principal debtor. [Sec. 140]

Example

X borrowed money from Y on the guarantee of W and mortgaged his house to Y, X failed to pay and W paid. Now, W can enforce the mortgage of the house against X.

b. Indemnity

In a contract of guarantee, there is an implied promise by principal debtor to indemnity the surety. The surety is entitled to recover from principal debtor whatever sum he has rightfully paid under the guarantee, but no sums which he has paid wrongfully. [Sec. 145]

Example

B owes Rs. 1 Lac to C, and A is the surety. B fails to pay. C demands payment from A. A refuses to pay. C sues A for money. A defends the suit but loses and pays debt with cost of suits. A can recover the whole amount from B.

3. Against Co-sureties

Where a debt is guaranteed by more than one surety, they are called co-sureties. The sureties are liable individually and collectively. Where sureties have jointly guaranteed the amount, they will contribute equally in case of default. If one of them pays more than his share, he can claim contribution from others

If the co-sureties have given guarantee for different sums, they will contribute equally but not exceeding their respective limits. [Sec. 146-147]

Examples

a. A, B and C jointly guaranteed to D for sum of Rs. 3 Lac. In case of default, they will contributed equally.

b. A, B and C guaranteed to D for sum of Rs. 2 Lac, 3 Lac and 4 Lac respectively. In case of default, they will contribute equally subject to the limit fixed by their guarantee.

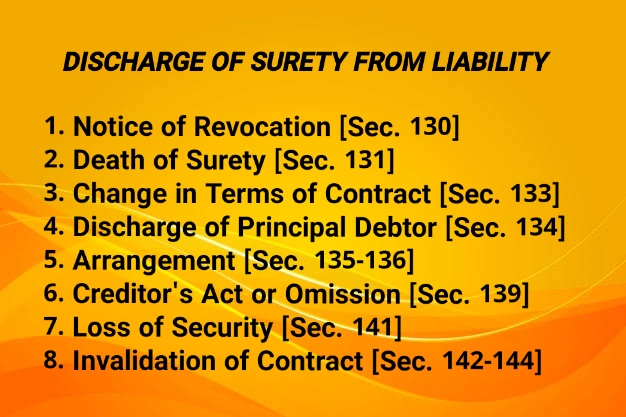

Discharge of Surety from Liability

A surety is discharged from his liability in the following ways:

1. Notice of Revocation

A specific guaranteed can be revoked by notice if it has not been acted upon. But a continuing guarantee may be revoked anytime by the surety as to future transactions by giving a notice to the creditor. The surety remains liable for transaction entered into prior to the notice. [Sec. 130]

Example

A lends B a certain sum on the guaranteed of C. C cannot revoke the guaranteed. But if A has not yet given the sum to B, then C may revoke the guarantee by giving a notice.

2. Death of Surety

In a specific guarantee, the surety is not discharged from liability on his death if liability has already occured. In a continuing guarantee, the death of surety discharges him from liability regarding the transaction after his death, unless there is a contract to the contrary. The estate of deceased surety will remain liable for past transactions. [Sec. 131]

Example

A sells goods to B for Rs. 1 Lac. C guarantees payment. A delivers goods worth Rs. 50,000. Later, C dies. C's property is liable up to Rs. 50,000.

3. Change in Terms of Contract

When any change is made in the terms of the contract by principal debtor and creditor without the surety's consent, the surety is discharged with respected to transactions subsequent to the change. [Sec. 133]

Example

My contracts to lend Rs. 1 Lac to N on 1st March. S guarantees payment. M pays the amount on 1st Jan. S is discharged from his liability.

4. Discharged of Principal Debtor

A discharge of principal debtor is also the discharge of surety. The surety is discharged by any contract between the creditor and principal debtor by which principal debtor is released. The surety is also discharged by any act or omission of the creditor the legal consequence of which is the discharge of the principal debtor. [Sec. 134]

Examples

a. D contracts to build a house for B. C guarantees for the performance. If B releases D from performance of the contract, the surety is discharged.

b. D contracts to build a house for B. B is liable to supply wood. C guarantees D's performance of the contract. B fails to supply the wood. C is discharged from his liability.

5. Arrangement

When the creditor, without the consent of surety, makes a promise with principal debtor to give more time to perform the liability or not to sue him, the surety is discharged from his liability. [Sec. 135]

When the creditor makes a contract with third person to give more time to principal debtor to perform the liability, the surety is not discharged. [ Sec. 136]

Examples

a. P purchased a car from C on guarantee of S. C gave P more time for payment. Held, giving more time to P for payment discharged S from his liability. (M.M. showroom Ltd vs. Newman)

b. D lends Rs. 10 Lac to B for 1 year on the guarantee of C. D promises E to give more time to B to return the loan. C is liable.

6. Creditor's Act or Omission

If the creditor does any act which is inconsistent with rights of the surety, or omits to do any act which he is required to do, and as a result the surety loses his remedy against the principal debtor, the surety is discharged. [Sec. 139]

Examples

a. B contracts to build a ship for C for Rs. 90 Lac to be paid by installments when the work reaches certain stages. A guarantees C for B's performance. Without telling A, C prepays last two installments. A is not liable.

b. N employs B as a cashier on the guarantee of M. N promises to count the cash at least once a month. N does not count the cash. B commits fraud. M is not liable.

7. Loss of Security

If the creditor, without the consent of the surety, loses the security given by the principal debtor against the debt, the surety is discharged from liability up to the value of security.

Example

Y lends Rs. 2 Lac to B on the guarantee of X. Y also gets B's car as a security of Rs. 50,000. Y cancels the security and return the car. B becomes insolvent. X is discharged from liability up to the value of car.

8. Invalidation of Contract

The surety is liable if a contract of guarantee is valid. A surety is discharged from liability when the contract of guarantee is invalid. It is invalid if guarantee is obtained by the misrepresentation, concealment of material facts, or the lacks some essentials of a valid contract. It is also invalid if guarantee is obtained under the impression that co-sureties will join but nobody joins. [Sec. 142-144]

Examples

a. D employs B as clerk. B commits fraud. Later, D takes guarantee from C without informing him about B's previous conduct. B again commits fraud. The guarantee is invalid

b. B signed a guarantee under the impression that three person would also sign it. One of them died without signing. The guarantee is not enforceable. ( NP bank of England vs. Brackenbury)

0 Comments

If you have any doubt, please let me know!